Navigation Map

- strategy (insurance, health, investments, finances);

- sustainable development (sales, employees, social responsibility, natural environment and ethics).

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

Operating model

Climate

Employee

Risk and ethics

Business

In the Chapter

Operating model

Climate

Employee

CSR

Risk and ethics

Market

Business

In the Chapter

Operating model

Employee

Risk and ethics

Business

In the Chapter

Operating model

Employee

Risk and ethics

Business

In the Chapter

Operating model

Climate

Employee

CSR

Risk and ethics

Digitalization – the future of insurance undertakings

GRIs

“It is important to remain up to date on what is going on in new technologies and what the trends are. We look at fintech and insuretechs undertakings as an opportunity for the entire sector. Having regard for the magnitude of our business, we are currently an attractive partner for many technological undertakings poising us to deliver the most sophisticated solutions to our clients while simultaneously becoming the leader of digital change on the Polish market.”

“It is important to remain up to date on what is going on in new technologies and what the trends are. We look at fintech and insuretechs undertakings as an opportunity for the entire sector. Having regard for the magnitude of our business, we are currently an attractive partner for many technological undertakings poising us to deliver the most sophisticated solutions to our clients while simultaneously becoming the leader of digital change on the Polish market.”

Digitalization is a process that has come to stay and is constantly developing in all sectors of both the global economy and our domestic economy. Investing in digital solutions generates a number of benefits not only for companies, their staff and their business partners but also for their clients.

Clients expect more and more personalized products, are aware of the risks arising from cybercrime and personal data management issues. According to the report1 prepared by Accenture in cooperation with the Polish Insurance Association, there is enormous potential associated with the digitalization of the insurance sector. The use of artificial intelligence and automation in processing large amounts of data is gaining in significance.

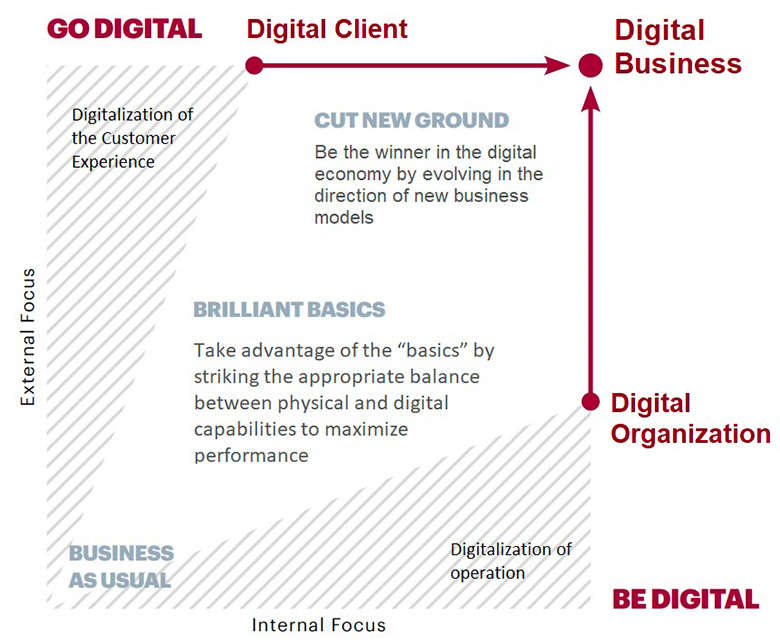

The model proposed by Accenture for a fully digital business calls for change on two of the most important planes. On one hand, this entails introducing the most advanced digital solutions in internal processes while, on the other hand, enabling clients to engage in the optimum amount of interaction with their insurer by using online tools. The PZU Group sees the need for digital transformation in both of these areas and applies the principle of gradually achieving full digitalization: by modifying internal processes and client communication channels.

Model examining the level of digitization in the organization

|

|

In Accenture’s global report Digital Consumers 2017 2, the following four main trends related to the digital development of organizations are distinguished:

Zródlo: Cyfryzacja Sektora Ubezpieczen w Polsce, Raport przygotowany przez Accenture we wspólpracy z Polska Izba Ubezpieczen |

The PZU Group is becoming more accomplished at recognizing the opportunities new technological implementations offer to the insurance sector. In our activities we always pose the question to ourselves, what challenges will our company and clients face not just in one or two years but how will the insurance services market look in 5 and 10 years. We also observe implementations in digitally advanced innovation hubs in Singapore, Israel and the United Kingdom. It is important for the organization to obtain “a view of tomorrow” because designing solutions that may be the standard in several years time must begin today. Looking at the growing supply of startups in insurance technology, big data analytics and financial services across the world, we are constantly searching for new sources of innovative projects both in Poland and abroad.

We understand the role artificial intelligence (AI) will play in digital transformation. The Accenture Report indicates that 62% of the study’s respondents are satisfied with the course of the processes supported by artificial intelligence and appreciate the benefits ensuing from that. In turn, 87% of consumers are highly interested in being able to monitor and check their personal data made available online. It is understandable that the connection with the digital environment is particularly big in younger age groups: the PZU Group’s prospective clients in upcoming decades. In our efforts to care for their best possible customer experience, convenience and safety, PZU has made digitalization one of the flywheels of growth.

The strength of the #newPZU strategy lies in technological support spanning the field of innovation and encompassing nearly all the Group’s operating areas. Multi-dimensional data analysis makes it possible to gain a better grasp of client needs, offer more efficient client service and provide for easier contacts with a greater amount of partnership. The means to execute these initiatives involve the usage of tools based on artificial intelligence, Big Data and mobile solutions.

In 2018 PZU launched the myPZU platform. This modern self-service offers the ability to obtain information in a single location to access PZU Group’s products and services and helps in the handling of numerous matters without having to visit a branch or call a hotline. It is accessible from any location and at any time on personal computers and through the myPZU mobile app. MyPZU is the most comprehensive platform available on the insurance, financial and health markets. It is continuously being upgraded with new functions.

PZU ushers in its ambitious technological plans into the Group’s strategy. As part of its efforts involving process optimization and automation, PZU uses artificial intelligence to identify and handle claims. Transformation of the organizational culture takes place at the level of employee involvement in new projects and pursuit of new initiatives. In turn, advanced analytics streamlines, among others, internal processes. To provide clients with a sense of data protection, the PZU Group focuses on cybersecurity. A multiple-layer system to protect against cybersecurity threats functions in the company and is being developed.

Key figures from the aforementioned best practices:

Artificial intelligence requires a mere 30 seconds to analyze technical documentation.

Artificial intelligence makes it possible to select 90% of the documentation that fulfills the requirements needed to preserve high quality of claims handling in PZU.

More than 882 thousand high risk attacks have been stopped.

More than 2.3 million malicious e-mails were blocked.

LINK4 as the first insurance company on the insurance market in Poland to sell products by phone continues to be a leader in direct insurance. The ongoing transformation into a data driven company involves development of the technology and organization around data collection and processing, machine learning and artificial intelligence. To this effect the Data and Advanced Analytics Center was established in LINK4. Its key tasks include data processing and preparation, development of predictive models and data reporting and visualization. The project’s overriding objective is to generate value through comprehensive and advanced data analysis in the entire organization. 2019 was also a year of testing different technologies in the company. In areas such as claims, client service, sale or back office, technologies in, among others, the following areas were tested: picture analysis, text analysis, speech/voice analysis and automatic search of processes for robotization. The achieved results show the technology’s great potential, which will be reflected in the company’s implementation schedule for 2020.

The banking industry is going through a major technological change – clients are utilizing products and processes in digital channels on a massive scale. The number of visits and transactions in branches is falling; the digitalization of economic activity is progressing. Moreover, finance and technology companies are getting more and more involved in areas reserved thus far solely to the financial sector.

For that reason digitization and digitalization are one of the strategic priorities for the banks operating in the PZU Group.

Since 2017 Alior Bank has been pursuing its “Digital Disruptor” strategy. It harnesses pioneering technological solutions such as blockchain, open banking, artificial intelligence and biometrics. It was the first bank in Poland to create a fully internet-based money exchange office. It is also responsible for launching the first in Poland video verification in the opening of personal accounts. In April 2019, Alior Bank ended the process of moving clients from the so-called old online banking to the new system. Online and mobile banking were enriched by a number of functions – both sales, transaction and service ones. Executing the process of moving the clients from branches to the digital world (the so-called project digitization), the systems were expanded to include a number of self-service functions.

Bank Pekao also continued its digital transformation process in 2019. This process has spanned more than 200 technologically advanced initiatives focused on development of sales and improvement of the quality of service in remote channels, automation and robotization of processes and enriching the offering to include state-of-the-art digital services. Bank Pekao’s electronic banking is systematically modernized and developed. Under the Digital Transformation Project, clients obtained access to a new version of the electronic banking service entitled new Pekao24. Pekao is consistently developing its modern PeoPay mobile app actively used by 1.4 million bank clients. In 2019 the bank has also given clients the possibility to open an online account themselves through the web by using a computer or a smartphone. Identity is verified by using biometric measurements of a face and a personal ID. Pekao is the first bank in Poland which offered the identity verification process based on face biometrics.

DIGITALIZATION IN COOPERATION AGENT – INSURER

DIGITALIZATION IN COOPERATION AGENT – INSURER

MULTI-CHANNEL ACCESS AND NO PAPER DOCUMENTATION

MULTI-CHANNEL ACCESS AND NO PAPER DOCUMENTATION

INCREASE THE SCALE OF CUSTOMER SELF-SERVICE

INCREASE THE SCALE OF CUSTOMER SELF-SERVICE

PROCESSES AUTOMATISATION

PROCESSES AUTOMATISATION

CONTINUOUS GROWTH OF ARTIFICIAL INTELLIGENCE

CONTINUOUS GROWTH OF ARTIFICIAL INTELLIGENCE

USE OF EXTERNAL DATA SOURCES

USE OF EXTERNAL DATA SOURCES

ECOSYSTEMS

ECOSYSTEMS

1 Digitalization of the Insurance Sector in Poland, a report prepared by Accenture in cooperation with the Polish Insurance Association

2 Dynamic Digital Consumers – ever-changing expectations and technology intrigue, Accenture, 2017